- OpenSea has a VC arm now for web3: https://opensea.io/opensea-ventures. Also “Ecosystem Grants” but smaller and more focused on NFTs.

- Didn’t know the parent; MetaMask and Infura and Truffle are all part of the ConsenSys suite: https://consensys.net/. Joe Lubin.

- Fundrise is a real estate investment fund. They charge ~1% in fees. Performance has been more stable than public REITs, lower highs and fewer lows. They do have a mint integration.

- https://fundrise.com/offerings/fundrise-ipo/view.

- Right now I average 70wpm @98% accuracy with just letters. When you add frequent capitals and special characters (practical daily coding), speed drops by half.

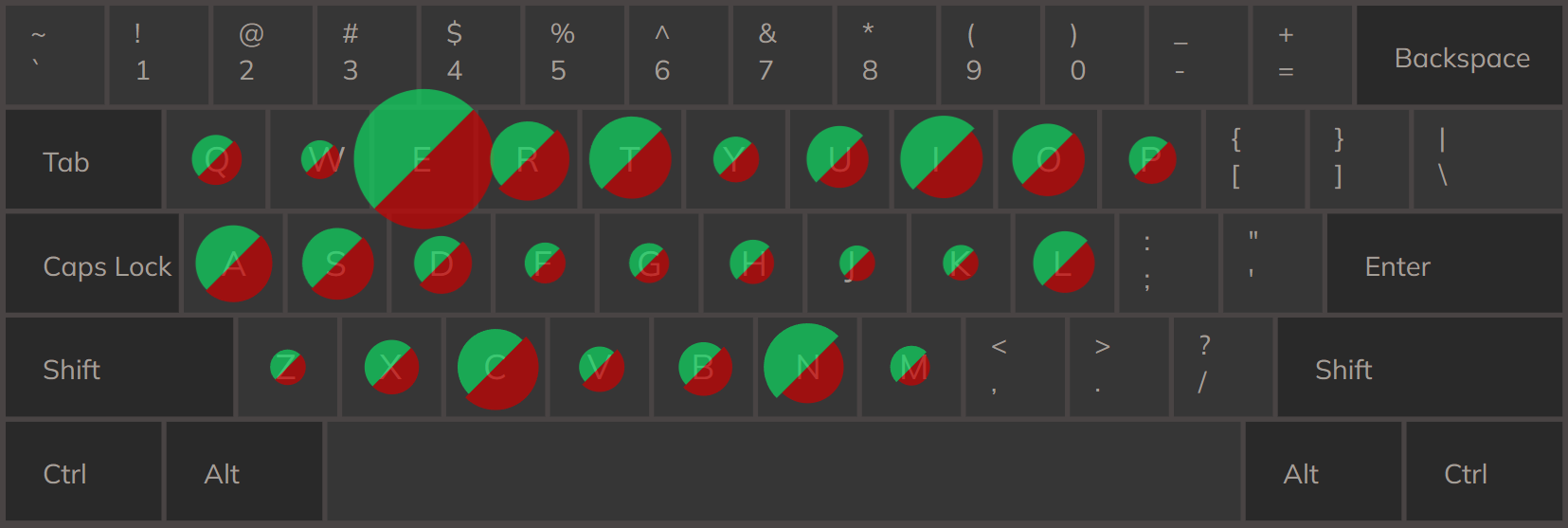

- My hits/misses and frequencies by key:

- Played with storage in devtools, inspected examples of what youtube stored in local (player volume) vs session (playback speed) vs cookies (login) vs indexeddb (logs, metadata).

- A cup is a cup is a cup. It has the same volume, no matter if it’s measuring a solid or liquid substance. It’s 8 fluid ounces ( = 237ml = 237 cm^3 = 14.5 in^3 ). The difference is that solid substances have different densities (fluid ounce normalizes on water), so mass is a better measurement for dry. The other difference is that dry measures have a flat top for levelling, wet measures have gradations and an uneven top spout for pouring.

- Just listened to that 434-video udacity webdev course in the background while working today instead of music. Was introductory and partially obsolete, but interesting bc hosted by Steve Huffman (reddit founder, yc 2005).

- To right-click with the keyboard: shift-f10, or the document key (right fn).

- Crypto VCs.

- Earliest rounds are SAFT; simple agreement for future tokens.

- Big US names: a16z, draper, polychain, paradigm, pantera, coinbase.

- 100k min for the pantera btc feeder fund.

- Polychain’s companies (79 public right now): https://jobs.polychain.capital/companies.

- Created a profile on their job network.

- Some etherscan endpoints to get transactions for an eth account/address: https://docs.etherscan.io/api-endpoints/accounts.

- See in their UI: https://etherscan.io/address/<yourPublicAddress>#transactions.

- Or https://etherscan.io/txs?a=<yourPublicAddress>

- There’s also a geth command: https://ethereum.stackexchange.com/questions/2531/common-useful-javascript-snippets-for-geth/3478#3478.

- There’s also Adamant’s python tool: https://github.com/Adamant-im/ETH-transactions-storage.

- And TrueBlocks: https://github.com/TrueBlocks/trueblocks-core.

- See in their UI: https://etherscan.io/address/<yourPublicAddress>#transactions.

- Mayor eric adams’ (public) paycheck is 10k, first in btc obv taken for a loss right now.

- Bridgesplit: DeFi but with non fungible tokens instead of fungible tokens.

- https://bridgesplit.com/. It’s on Solana.

- Put your NFTs up as collateral for loan, use them to yield farm (not sure how they do this, nothing to stake), index them, more.

- Sounds like you can get interest by providing liquidity to NFT indexes. Pool a bunch of NFTs together (fractionalized or full) and allow people to buy in, all in smart contracts.

- Offers NFT fractionalization too, so the bar for blue-chip NFTs is lower.

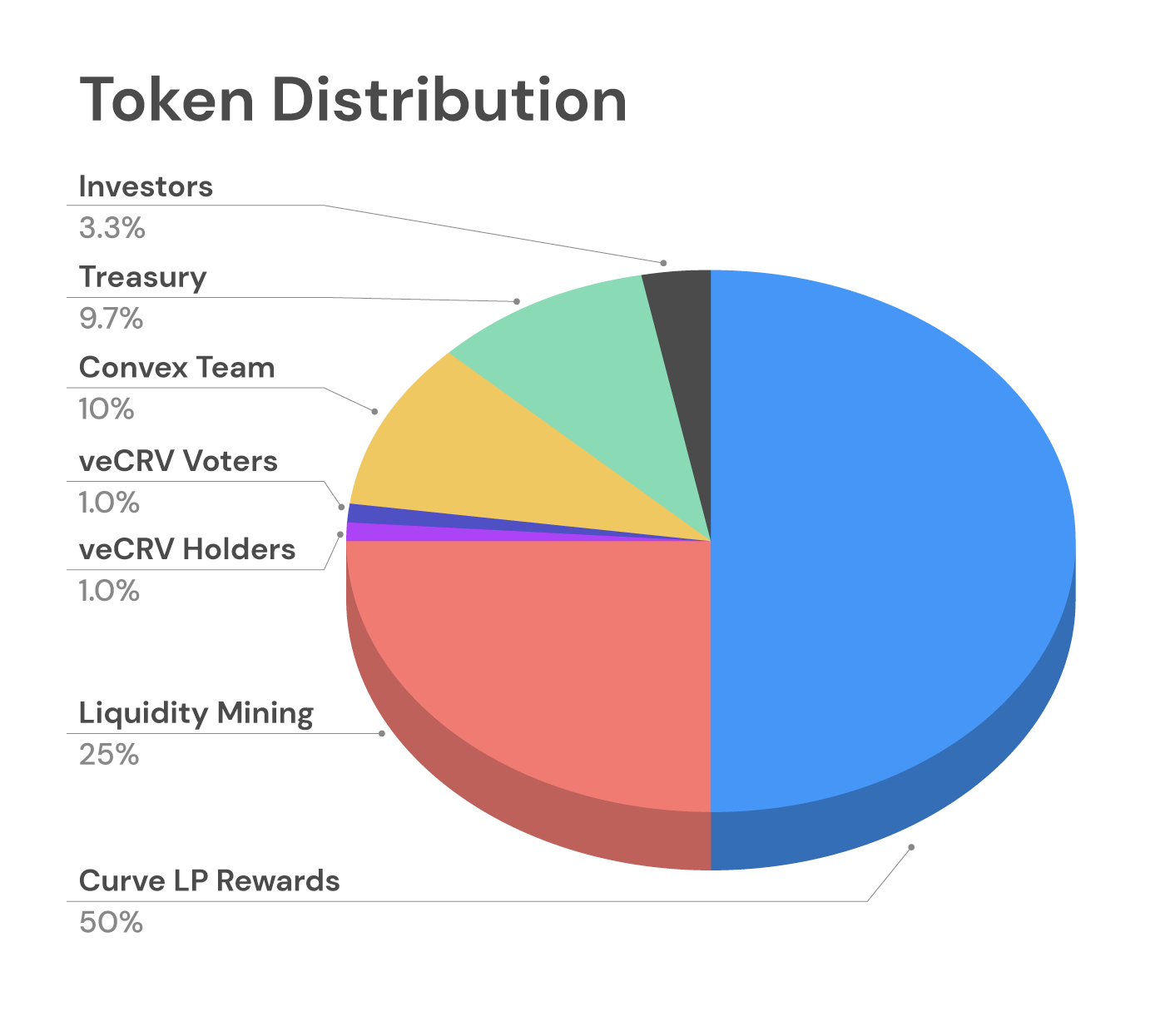

- Tokenomics is the overall distribution. What % is issued, burning, held, mined, invested, locked in contracted, liquid, etc. Example:

- Getro provides a linkedin integration to pull a user’s data to something like a job board.

- 1inch. https://1inch.io/.

- An aggregator. A liquidity aggregator. Compares a ton of live swaps.

- Checks across multiple DEXes on many networks (eth, bnb, polygon, optimism, gnosis, avalanche, arbitrum) to execute your trades at best quotes and lowest fees.

- Will play with this for my next few swaps.

- Another platform with a unicorn logo.

- Joined a few socials, twitter/discord/reddit/medium.

- 1INCH is #103 on coinmarketcap right now with 610m market cap.

- CyberMondays NYC.

- Reread the uniswap v3 whitepaper: https://uniswap.org/whitepaper-v3.pdf.

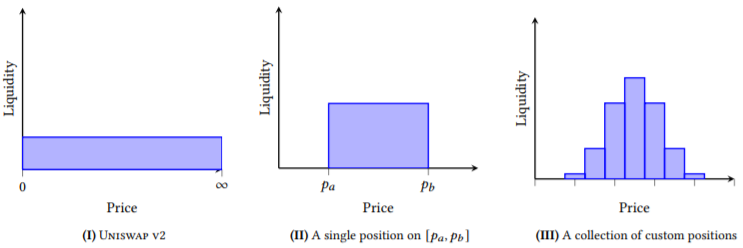

- Constant product market makers are capital inefficient. Only a fraction of the assets are available at a given price. Concentrated liquidity improves this, allowing liquidity providers to specify their price range.

- Remember the basics of AMMs with constant product. If I want to trade WETH for ETH, I am not going to get the same amount back, even though they have the same price. As I contribute more WETH to the pool, it becomes higher in supply and lower in demand. So I get less ETH back. The product of both total reserves must stay constant. As the reserves go up, and liquidity becomes very high, these impacts are less and less.

- Remember this 50:50 ratio is all the value, not the number. So it’s usually converted to USD (via USDC). Eg it’s not 1BTC:1ETH, it’s 1BTC:14ETH.

- Some people intentionally move the price a lot on a small pool (where it’s easier to do so) and then arbitrage it themselves. Buy the asset after you’ve lowered it, then sell/swap on another exchange for the normal price. This is possible if the money required to move the price is small enough for the arbitrage to be more than the fees.

- Note too that this is what makes impermanent loss possible. The price ratio of asset1/asset2 must stay constant for that pool. But it could be different in another pool. So while both pools will follow the general market trend, due to buys/sells, they may do so at different rates.

- Enter 1inch!

- Liquidity is made discrete. Prices are separated into ticks; you can’t just specify your own custom float.

- If the price goes out of range, you stop earning fees, and all of that asset will be converted to the other (you’ll only have 1 token type in your liquidity pool).

- V3 also added fee tiers. There’s a liquidity pool for each token pair AND fee tier now. Used to be 0.3% for all. This is too high for stable pairs (can be 0.05% now), and too low for volatile pairs (can be 1% now).

- Fees are not automatically reinvested as additional liquidity in the pool now. They’re paid separately. They used to give you fungible LP tokens for the pair. But now, you are only providing liquidity over a custom range, not identical to anyone else’s; so you get nonfungible LP tokens back.

- Better oracle, you can now query recent price accumulator values. v2 only had the most recent. v3 has history.

- Some platforms like Balancer allow different ratios than 50/50. Can even have an LP with something like 98/2.

- Other platforms allow more than 2 assets. Can have something like 8 tokens in a pool. Math gets more complicated.

- The primary alternative to an AMM: an order book. Buyers place a buy order for a quantity/price they desire, sellers place a sell order. A trade is initiated when a buy order and a sell order match.

- History: uniswap v1 was all the pairs of (X/ETH). Everything traded with eth. So to go from USDC to BAT, you’d swap twice. V2 allow pools of any pair, so you could go direct. Both v1 and v2 were constant product, then v3 came out with concentrated liquidity.

- I think Whiteboard Crypto’s youtube videos are better than Finematics’.

- Kalshi.

- https://kalshi.com/. Binary markets (mostly. there are some ranges).

- Legal in the US and NY.

- Polymarket, but newer and gaining steam.

- Chainedmetrics, but markets for anything (not just KPIs).

- Kalshi is not on a blockchain. You connect a bank account and trade with USD. It just uses event contracts like polymarket and others do. Then what’s the difference between Kalshi and a standard web2 prediction market like PredictIt?

- Libra.

- Started in 2017. Renamed to Diem in december 2020. Project abandoned in Jan 2022.

- Was originally planned to be backed by a basket of difference currencies, and then reduced to just stablecoin backing.

- Offered a robust payment system. And Novi the wallet (formerly Calibra).

- Not decentralized; facebook/meta would be an authority. Only members of Libra/Diem association could mine blocks. Lots of huge company names in this ~30 member group.

- Written in rust.

- Biggest issues were regulation and opposition from banks.

- The vestiges were sold to Silvergate for 200m.

- Some of the old libra team is working now to start a new L1 blockchain called Aptos.

- Others from the old libra team split off (with a16z funding) to start Mysten Labs: https://mystenlabs.com/. Their goal is to build tooling/infrastructure/platform to accelerate others onto web3. https://medium.com/mysten-labs/introducing-mysten-labs-building-foundational-infra-for-web3-7e5ec3df1ccb. Read a bit and followed discord/twitter/medium.

-

Monday

-

Sunday

- Lex Fridman + Mark Zuckerberg: https://www.youtube.com/watch?v=5zOHSysMmH0. Some interesting segments.

- Bought march madness weekend vegas flight, 1k roundtrip.

- Metamask still working on improving NFT support natively in the extension.

- Did an es6 and react17 refresher. Typescript too. Went through some MDN web docs. Full notes in gdrive.

- Beginner-focused: https://www.taniarascia.com/getting-started-with-react/.

- React’s tutorial game: https://reactjs.org/tutorial/tutorial.html.

- Docs for main concepts: https://reactjs.org/docs/hello-world.html.

- Thinking in React: https://reactjs.org/docs/thinking-in-react.html. This is a good one.

- Think about the component hierarchy first.

- Then build it statically to render the data model, just with props and no state.

- Then decide what should be state. Stuff that can be calculated from other state, with no additional changing info, can be passed with props.

- Then decide which component should hold that state. It should be the topmost, common owner.

- Then have the state flow data. Each component only updates their own, then pass callbacks to children to update.

- Disabled GitLens’ annoying “Git Code Lens” which puts vcs history INTRA file at the top of code blocks. Terrible. Left “Current Line Blame” which is great.

- Moved all my GitLab repos from the “Brian Mahlstedt’s Group” namespace to simply my user namespace bmahlstedt (this didn’t exist years ago when I first started using gitlab).

- Semantic note – the highest perm you can have in a user namespace is Maintainer, so you’ll be downgraded from Owner (only applicable in Groups).

- https://gitlab.com/bmahlstedt.

- Full Udacity webdev course, ~450 videos, each 1-2mins. 7 years old though. https://www.youtube.com/playlist?list=PLAwxTw4SYaPlLXUhUNt1wINWrrH9axjcI.

-

Saturday

Bit of a different post today – my journey with severe sciatica and L4-L5 disc herniation from many years of long hours at a seated desk.

On/off from 29-34, bouts that would last about a month. Some moderate. Some severe. Really bad/persistent in the fifth year. Really bad in the last 6 months at the end of 2021, before I finally took it seriously.

Pain is 9 of 10 when in flexion. Can’t give out 10s. Feels like you’re shearing your spine in two while hornets attack your numb leg. Pain is 5 of 10 when idle. The latter is worse. 24/7, inescapable. Pain when lying flat, pain when sitting, pain when standing, pain when X. Grinds you down. Puts you in a mental corner where frustration and confusion start to dilate your perception of the current pain level and if it will ever get better.

Can’t sleep more than 2 hours without pain and stiffness becoming too unbearable to remain down. Get up, pace to reduce pain from 7 back to 5, then back to sleep for another couple hours.

Easily the hardest year of my life physically. Can’t put on your own shoes, can’t exercise, can’t sleep. Can’t sit down for a year. Think about what you did yesterday that required a seat: Go anywhere in a car? Watch TV on a couch? Met a friend for dinner? Avoid all of those for 12 months.

Nearly 50 treatments. Some weekly, most daily:

- Physical therapy

- Epidural

- X-ray + MRI

- Cyclobenzaprine

- Meloxicam

- Methylprednisolone

- NSAIDs

- Golf ball on foot

- Theragun

- Heat pad

- Traction belt (dds300)

- Sciatica compression belt

- Ice belt

- Hamstring stretches

- Piriformis stretches

- Foam roll

- Core strengthening

- Acupuncture

- Acupressure mat/pillow

- Chiro

- Massage

- Standing desk, never sitting

- Lumbar arch device

- Walking, mild exercise

- Steam room

- Infrared sauna

- Mild yoga

- Meditation

- Cold showers

- Glutamine

- Good diet, anti-inflammatories like turmeric etc

- Sleeping on stomach every night (I’m a back sleeper), bit more extension

- Book: 8 Steps to a Pain-Free Back

- Bob and Brad on YouTube

- Tiger balm and Ping On ointment

- CBD cream

- Kratom

- Nasal and diaphragm breathing, including sleep mouth strips

- No exercise in morning until warm, discs have imbibed overnight and need to settle

- Hanging from pullup bar

- McKenzie side glides

- McKenzie extensions

- McKenzie lumbar sleep roll

- Leg wedge pillow for sleeping

- Complete avoidance of any flexion

- Shoe horn

- Nerve flossing

- TENS (stim)

I’m about 70% better, after the worst year leading into 6 months of active physical therapy (hours every day). No surgery. I hope to be 100% in another year, although there may be lifelong remnants. I can sleep now, which is the world. There was that ~1 month where I truly could not sleep more than 2 hours straight, waking from acute pain and requiring a walk multiple times every night. Being past that is an entirely different recovery.

Take care of your back. Move, stand, stretch, extend.

-

Friday

- Coinbase q4 earnings beat EPS 48.53% @3.35, beat rev 25.40% @2.5b.

- SEO is so important. https://developers.google.com/search/docs/advanced/guidelines/get-started.

- Top 10 nginx config mistakes: https://www.nginx.com/blog/avoiding-top-10-nginx-configuration-mistakes.

- worker_connections, defaults for each worker to have at max 512 connections. Could be a file descriptor managing the client-server connection, could be an FD for a log, could be an FD for a served file, could be many others. But the os limits FDs per process, usually default 1024. Make sure these aren’t in conflict, set worker_rlimit_nofile.

- “error_log off” does not disable error logging; it writes error logs to a file called “off”. Pipe to devnull if you want to actually turn off (which you don’t).

- When proxying requests to backend servers, nginx by default creates/closes a new connection for each. This can be inefficient (and exhaust all ports in a dos). Include the “keepalive” directive in every “upstream” block.

- Remember nested blocks inherit from their parent. If both contain the same directive, the child replaces (doesn’t add). This is confusing with directives like “add_header” – ONLY the childmost will count.

- “proxy_buffering” is on by default. Nginx will internally buffer the full response before sending ANY data to the client. You can turn this off, and nginx will start sending data back right away, but the cons almost always outweigh the pros. It will lock nginx up when dealing with slow clients, rate limiting and caching are all impacted, more.

- The “if” directive should only be used with “return” and “rewrite” – can segfault when used with others.

- Don’t overuse the “health_check” – only once per upstream (proxy_pass) block.

- “stub_status” provides great nginx metrics, but also exposes data that can be used to compromise your site. Don’t use this on a location without auth.

- “ip_hash” will load balance, but only using the hash of the first 3 octets of the client IP (v4). If all of your clients are in the same /24 cidr block, they won’t be load balanced and will all have the same hash and be sent to the same upstream. Switch “ip_hash” to “hash $binary_remote_addr consistent”.

- Create upstream groups. You can share resources, enforce a consistent config, improve performance, more.

- Even after 20 years of regular computer use, I still find it valuable to sporadically do formal keyboarding exercise. I probably slow from 60wpm/80% to 40wpm/95%, but then normalize to >60wpm with good accuracy. c and x are toughest for me, ring/middle dexterity with left hand.

- Cert expired on supercontest (autorenew bot should handle this) – will resolve soon.

-

Thursday

- AWS:Innovate. AI/ML.

- Watched the opening and closing keynotes, as well as a few sessions on MLOps.

- Bratin Saha, VP of AWS ML/DL.

- Full data strategy: infra, workflows, analytics, scalability.

- Athena to sql query s3, emr for big data processing, kineses for analytics, redshift for warehouse, opensearch for log analysis. Many options for datastores obv.

- AWS Personalize: suggestion engine.

- ML can extract insights from unstructured data. Multimodal processing.

- Of course sagemaker for training. Airflow and sagemaker pipelines and aws step functions for pipelines. Codebuild/codecommit/codepipeline for the CI bits.

- Build, test, train, and monitor models. Sagemaker has tools for all.

- Automatic bug detection, earlier in the process. Profilers, pull request analytics, everything. Shift left. AWS CodeGuru.

- Amazon DevOps Guru as well. Pulls data from a ton of monitoring sources and detects anomalies. Similar to Datadog’s watchdog.

- IPv6 was introduced 26 years ago, and formally released 10 years ago.

- Modified a few of my LP and vault positions.

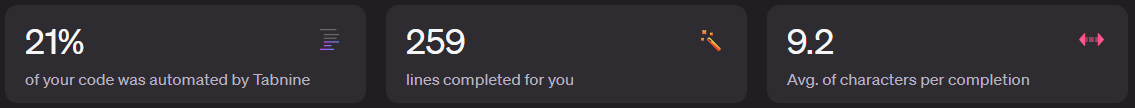

- Tabnine last 30 days:

- Other.

- The border of california is more northern than both manhattan and the southern tip of canada.

- Cold smoking is usually below 90F.

- Russia/ukraine. Energy prices, oil/gas up. MOEX down 45%.

- Business.

- The Foundations of Entrepreneurship (101 Crucial Lessons They Don’t Teach You In Business School). https://www.youtube.com/watch?v=UEngvxZ11sw.

- Relationships are more important than product knowledge. Bond before business.

- Meh. Got about 20 minutes in and had to turn it off. He started talking about Tony Robbins and God, rather than actual experience he had with technical startups and founding a modern business. Was too snake oil salesman-y.

- Did some photoshop on mobile (surprisingly featureful).

- Query execution changed in the planner after postgres major version update: https://ardentperf.com/2022/02/10/a-hairy-postgresql-incident/.

- QRF = quick reaction force. The side team to handle unplanned work while the majority team executes on the planned roadmap. Same as a proper devops rotation: https://betterprogramming.pub/engineering-org-structures-the-qrf-team-model-7b92031db33c.

- How shazam works: https://www.cameronmacleod.com/blog/how-does-shazam-work. Spectrogram (frequencies, fourier transform), find the largest peaks (across many time segments) so you’re robust to background noise / voices / etc, then hash and put in a database. Precompute this for all songs, then recognition is just a query against this.

- Carta, comp+equity management platform: https://carta.com/private-companies/total-compensation-management/.

- Provides tools for companies to manage employees, salaries, bands, equity offerings, bonuses, vesting schedules, current levels vs target levels, relativity, liquidation events, everything you’d expect. Benchmarking, suggestions, leveling. Location-specific autoadjustment. Cap table management and adjustment through funding rounds.

- Connects to your already-existing HRIS (human resources information system) software.

- I’m much more familiar with Shareworks. https://carta.com/carta-vs-shareworks/.

- They’re building CartaX, a private equity market to provide liquidity: https://cartax.com/.

- We’ll see how CartaX does against EquityZen.

- SpaceX 10:1 stock split: https://www.cnbc.com/2022/02/18/elon-musks-spacex-performing-10-for-1-stock-split.html.

- Ycombinator refresher.

- 2 rounds per year, each is 3 months (jan-mar and june-aug). Group office hours, meeting other founders, weekly speakers, demo day, networking with investors, seed funding.

- $500k total. $125k safe for 7% ownership, $375k Most Favored Nation safe.

- Lots of uncommon cases still participate; solo founders, people who don’t need the money, projects that are already mature, projects that haven’t started.

- Average age is ~29.

- At this moment, they’ve funded over 3k companies and 7k founders. Big alumni network.

- Top companies to come out of yc: airbnb, stripe, doordash, coinbase, gitlab, dropbox, pagerduty, instacart, reddit, relativityspace, opensea.

- Before applying to the actual yc program, most go through startup school (free, online): https://www.startupschool.org/.

- They’re the most popular accelerator by a large margin. Second is probably TechStars.

- Joined CryptoMondaysNYC (7.5k members) and BlockchainNYC (9.5k members) on meetup, RSVPed for a few upcoming events.

- And NY Software Engineers and NY Tech Tank.

- And NYC BBQ Meetup.

- MEV = maximum extractable value or miner extractable value.

- Modifying transaction order in a block to maximize the value (above the standard block reward + gas). Someone found a solid DEX arbitrage? Before you mine the block and include their transaction, put a duplicate transaction with higher gas fees into the mempool so it clears first, then mine the block. You win.

- Obviously miners can do this, but you can write algorithms to scrape the mempool and find profitable MEV opportunities. These are called searchers. They frontrun by replacing the transaction with their output address, and pay a higher gas fee so yours goes first.

- DEX arbitrage is the most common example. 2 exchanges offer the same token for different prices. Buy on the low one and sell on the high one.

- Example: https://etherscan.io/tx/0x5e1657ef0e9be9bc72efefe59a2528d0d730d478cfc9e6cdd09af9f997bb3ef4. ETH->DAI on uniswap, then DAI->ETH on sushiswap. 4.56% difference. Took out a flash loan of 1000eth on aave, so made 45.6 ether in a moment.

- Another MEV: liquidation fees on lending protocols. If I borrow the max of 75% of my supply, and the value of those borrow/supply coins changes to exceed 75%, I’m obviously eligible for liquidation. The borrower has to pay a fee to the liquidator if this happens. The searcher parses the blockchain for liquidation opportunities and submit the liquidation transaction. (?) I thought the protocol would be 100% responsible for this, not some random person.

- Example: this guy made 3869eth on a single liquidation event on Compound: https://etherscan.io/tx/0x988fe12325b2d2f33da43e5203ee8ba21e25b8c55f2ea705a1024a057a9718e6.

- Sandwich trading. If you see a pending transaction where someone is swapping 1 billion USDC for ETH, you know the price of ETH will go up. So you quickly buy ETH before the whale transaction clears, then sell it right after.

- NFTs. Writing a program to buy an entire collection to monopolize, then resell at higher. Or a bot that scrapes an accidental listing at below floor price.

- https://github.com/flashbots/pm.

- https://explore.flashbots.net/leaderboard.

- This is obviously very lucrative, and nefarious is some ways. Increases slippage, frontrunning, etc. What many people do now is basically private mempools, working with specific miners to guarantee a transaction. Flashbots is the company working on this.

- Good summary from August 2020, 1.5yrs ago: https://www.paradigm.xyz/2020/08/ethereum-is-a-dark-forest. I am very late to this. Pandemic+citadel+crosscountry = very distracting.

- The Flash Boys 2.0 whitepaper on this: https://arxiv.org/pdf/1904.05234.pdf. Primarily Phil Daian, Cornell.

- AWS:Innovate. AI/ML.

-

Wednesday

- https://www.forbes.com/sites/laurashin/2022/02/22/exclusive-austrian-programmer-and-ex-crypto-ceo-likely-stole-11-billion-of-ether/?sh=29adf2db7f58.

- 2016 Ethereum DAO hack, 3.64m eth. TenX CDEO Toby Hoenisch.

- Discord.

- Bug – not marking messages as read, even when scrolling to the bottom. This was happening on the browser app, not mobile or desktop.

- FIXED. Zoom out a single click.

- Deepdived the API.

- Familiarized with a ton of channels I had previously just skimmed.

- Would love to be able to collapse member lists by roles in the side panel.

- Bug – not marking messages as read, even when scrolling to the bottom. This was happening on the browser app, not mobile or desktop.

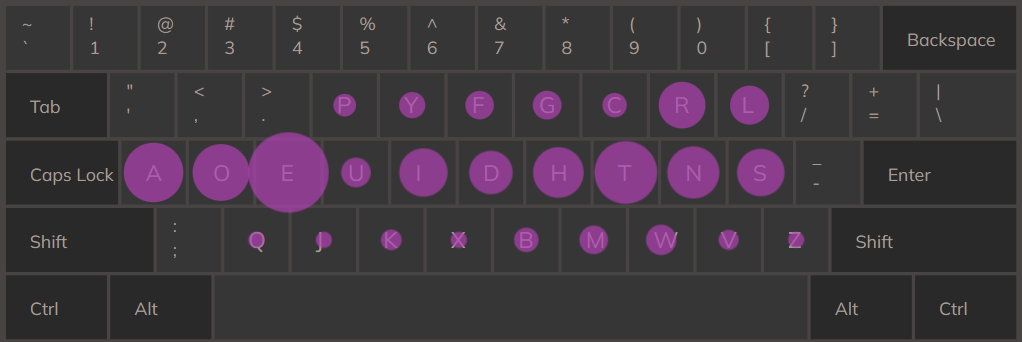

- Qwerty has 37% key frequency on the home (middle) row and 50% on top and 13% on bottom. Dvorak has 71 / 20 / 9.

- Business research. Legal structure, registration, insurance, taxes, funding, marketing, planning, hiring. LOIs, term sheets.

- Retention (recurrence), growth rate, customer acquisition cost, average order value, lifetime value (of a lifetime customer), payback period (how quickly you get money from customers). You want LTV/CAC to be >3.5. If it costs $100 to get and retain a customer, and the “full” value you’d get from them is $500, that’s good.

- Added https://blog.jonlu.ca to my feedly, reports 53 followers / 1 post per month.

- Lots of common interests in scraping, churning, streaming, much more.

- Replaying m3u8 (playlist files that point to media) in your own video player. But then you need certain headers (referer). You can fake some of these, but chrome will not allow others. node-xhr2-unsafe.

- Zapier (workflow automation tool) can connect feedly with gmail to send a notification when any of your followed publishers post, but it requires feedly pro.

- Twitch Justin Kan about sobriety and ayahuasca: https://www.youtube.com/watch?v=YZEmzuf73tE.

- Metamask has a new gas view on transaction confirmation. Allows you to specify low/market/aggressive with estimated costs, as well as how the current gas compares to the recent times.

- Terra/anchor refresher.

- Anchor whitepaper: https://www.anchorprotocol.com/docs/anchor-v1.1.pdf.

- The APY paid as interest to users who deposit in an anchor savings account…comes from block rewards across all major PoS chains. Anchor invests deposits in a dynamic staking portfolio.

- UST. Current APY 19.4%. Remember Lido is ~10% rn. Plus native delegation.

- A germinating seed’s first leaves can sometimes be confused for the cotyledons. This is technically the embryo, the internal layer surrounding the seed, and yellows like a dying plant.

- This scared me, but is normal; particularly in sunflowers, which I observed at home. It supplies nutrients to the rest of the budding plant (including the true leaves) then dies.

- Played with burp suite a bit more – basically a debugger for http chains.

- Proxy/intercept requests and evaluate/modify headers/payloads/etc.

- Modify a qparam like &price=15 to &price=1 to exploit. Obv many other usecases.

- Decided not to vault stETH on yearn; gas outweighed my seed + 4.37 curve APY.

- https://www.forbes.com/sites/laurashin/2022/02/22/exclusive-austrian-programmer-and-ex-crypto-ceo-likely-stole-11-billion-of-ether/?sh=29adf2db7f58.

-

Tuesday

- 2022-02-22. A fun reminder that no publications (omg palindrome!) abide by ISO 8601 (or common sense of hierarchies).

- Rarity checker for NFTs: https://rarity.tools/. Ranks all minted NFTs within a collection by rarity of their properties. Costs 2ETH to list your project on there.

- NFT worlds is #1 is vol over last 7d on opensea: https://opensea.io/collection/nft-worlds. Minecraft compatible pieces of land.

- Played a bit with opensea and metaplex.

- Looks like for solana: magic eden currently is #1 in volume, then solanart, then solsea. Solanart is the most similar interface as opensea.

- Pyth is the solana oracle: https://pyth.network/.

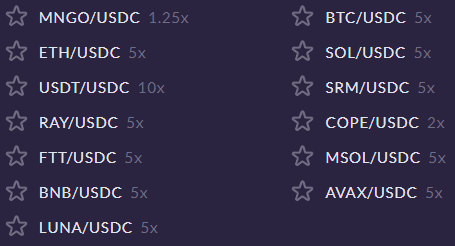

- Mango (on solana) offers spot margin for trading. https://trade.mango.markets/. I assume you must deposit collateral, just like lending.

- PsyOptions too: https://www.psyoptions.io/.

- Cogent crypto came out with an article today that covers a lot of what I blogged about last week: https://medium.com/@Cogent_Crypto/solana-staking-guide-part-2-advance-staking-strategies-335337b77ec9.

- Great calculator for solend+marinade yield farming: https://cogentcrypto.io/LendingAPYCalculator. mSOL, SOL, MNDE, and SLND.

- Added <a href=”/”> to blog site title.