-

- AWS:Innovate. AI/ML.

- Watched the opening and closing keynotes, as well as a few sessions on MLOps.

- Bratin Saha, VP of AWS ML/DL.

- Full data strategy: infra, workflows, analytics, scalability.

- Athena to sql query s3, emr for big data processing, kineses for analytics, redshift for warehouse, opensearch for log analysis. Many options for datastores obv.

- AWS Personalize: suggestion engine.

- ML can extract insights from unstructured data. Multimodal processing.

- Of course sagemaker for training. Airflow and sagemaker pipelines and aws step functions for pipelines. Codebuild/codecommit/codepipeline for the CI bits.

- Build, test, train, and monitor models. Sagemaker has tools for all.

- Automatic bug detection, earlier in the process. Profilers, pull request analytics, everything. Shift left. AWS CodeGuru.

- Amazon DevOps Guru as well. Pulls data from a ton of monitoring sources and detects anomalies. Similar to Datadog’s watchdog.

- IPv6 was introduced 26 years ago, and formally released 10 years ago.

- Modified a few of my LP and vault positions.

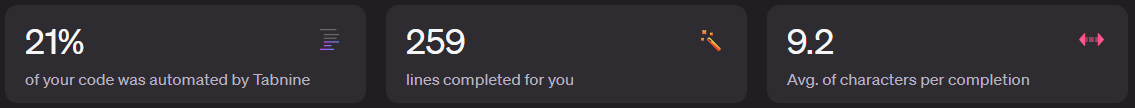

- Tabnine last 30 days:

- Other.

- The border of california is more northern than both manhattan and the southern tip of canada.

- Cold smoking is usually below 90F.

- Russia/ukraine. Energy prices, oil/gas up. MOEX down 45%.

- Business.

- The Foundations of Entrepreneurship (101 Crucial Lessons They Don’t Teach You In Business School). https://www.youtube.com/watch?v=UEngvxZ11sw.

- Relationships are more important than product knowledge. Bond before business.

- Meh. Got about 20 minutes in and had to turn it off. He started talking about Tony Robbins and God, rather than actual experience he had with technical startups and founding a modern business. Was too snake oil salesman-y.

- Did some photoshop on mobile (surprisingly featureful).

- Query execution changed in the planner after postgres major version update: https://ardentperf.com/2022/02/10/a-hairy-postgresql-incident/.

- QRF = quick reaction force. The side team to handle unplanned work while the majority team executes on the planned roadmap. Same as a proper devops rotation: https://betterprogramming.pub/engineering-org-structures-the-qrf-team-model-7b92031db33c.

- How shazam works: https://www.cameronmacleod.com/blog/how-does-shazam-work. Spectrogram (frequencies, fourier transform), find the largest peaks (across many time segments) so you’re robust to background noise / voices / etc, then hash and put in a database. Precompute this for all songs, then recognition is just a query against this.

- Carta, comp+equity management platform: https://carta.com/private-companies/total-compensation-management/.

- Provides tools for companies to manage employees, salaries, bands, equity offerings, bonuses, vesting schedules, current levels vs target levels, relativity, liquidation events, everything you’d expect. Benchmarking, suggestions, leveling. Location-specific autoadjustment. Cap table management and adjustment through funding rounds.

- Connects to your already-existing HRIS (human resources information system) software.

- I’m much more familiar with Shareworks. https://carta.com/carta-vs-shareworks/.

- They’re building CartaX, a private equity market to provide liquidity: https://cartax.com/.

- We’ll see how CartaX does against EquityZen.

- SpaceX 10:1 stock split: https://www.cnbc.com/2022/02/18/elon-musks-spacex-performing-10-for-1-stock-split.html.

- Ycombinator refresher.

- 2 rounds per year, each is 3 months (jan-mar and june-aug). Group office hours, meeting other founders, weekly speakers, demo day, networking with investors, seed funding.

- $500k total. $125k safe for 7% ownership, $375k Most Favored Nation safe.

- Lots of uncommon cases still participate; solo founders, people who don’t need the money, projects that are already mature, projects that haven’t started.

- Average age is ~29.

- At this moment, they’ve funded over 3k companies and 7k founders. Big alumni network.

- Top companies to come out of yc: airbnb, stripe, doordash, coinbase, gitlab, dropbox, pagerduty, instacart, reddit, relativityspace, opensea.

- Before applying to the actual yc program, most go through startup school (free, online): https://www.startupschool.org/.

- They’re the most popular accelerator by a large margin. Second is probably TechStars.

- Joined CryptoMondaysNYC (7.5k members) and BlockchainNYC (9.5k members) on meetup, RSVPed for a few upcoming events.

- And NY Software Engineers and NY Tech Tank.

- And NYC BBQ Meetup.

- MEV = maximum extractable value or miner extractable value.

- Modifying transaction order in a block to maximize the value (above the standard block reward + gas). Someone found a solid DEX arbitrage? Before you mine the block and include their transaction, put a duplicate transaction with higher gas fees into the mempool so it clears first, then mine the block. You win.

- Obviously miners can do this, but you can write algorithms to scrape the mempool and find profitable MEV opportunities. These are called searchers. They frontrun by replacing the transaction with their output address, and pay a higher gas fee so yours goes first.

- DEX arbitrage is the most common example. 2 exchanges offer the same token for different prices. Buy on the low one and sell on the high one.

- Example: https://etherscan.io/tx/0x5e1657ef0e9be9bc72efefe59a2528d0d730d478cfc9e6cdd09af9f997bb3ef4. ETH->DAI on uniswap, then DAI->ETH on sushiswap. 4.56% difference. Took out a flash loan of 1000eth on aave, so made 45.6 ether in a moment.

- Another MEV: liquidation fees on lending protocols. If I borrow the max of 75% of my supply, and the value of those borrow/supply coins changes to exceed 75%, I’m obviously eligible for liquidation. The borrower has to pay a fee to the liquidator if this happens. The searcher parses the blockchain for liquidation opportunities and submit the liquidation transaction. (?) I thought the protocol would be 100% responsible for this, not some random person.

- Sandwich trading. If you see a pending transaction where someone is swapping 1 billion USDC for ETH, you know the price of ETH will go up. So you quickly buy ETH before the whale transaction clears, then sell it right after.

- NFTs. Writing a program to buy an entire collection to monopolize, then resell at higher. Or a bot that scrapes an accidental listing at below floor price.

- https://github.com/flashbots/pm.

- https://explore.flashbots.net/leaderboard.

- This is obviously very lucrative, and nefarious is some ways. Increases slippage, frontrunning, etc. What many people do now is basically private mempools, working with specific miners to guarantee a transaction. Flashbots is the company working on this.

- Good summary from August 2020, 1.5yrs ago: https://www.paradigm.xyz/2020/08/ethereum-is-a-dark-forest. I am very late to this. Pandemic+citadel+crosscountry = very distracting.

- The Flash Boys 2.0 whitepaper on this: https://arxiv.org/pdf/1904.05234.pdf. Primarily Phil Daian, Cornell.