-

- Cold hit 7degF this morning – is that the coldest temp I’ve ever been in my life? I think so. Doesn’t compare to the agony of the grapevine on the motorcycle, but this is probably the coldest abs temp.

- Supercontest had the issue again where you couldn’t select the second-to-last (from the bottom) matchup. Only on mobile.

- Same as https://gitlab.com/bmahlstedt/supercontest/-/issues/167

- Was actually able to reproduce on desktop using devtools’ simple device toolbar (iphone 12 pro).

- It was the dashflo widget for discord chat. Removed it (stopped supporting between seasons a couple years ago, will bring back later).

- Nearly 4 years later, got the settlement from the equifax data breach in 2019! $5.31.

- Lots of private work.

-

- One of the strangest weather days I’ve seen. Dropped from 50 to 10 degF over the course of 6hrs.

- Spent the day doing a bunch of stochastic modeling.

- The word for “females and males being separate” is dioecious. The opposite is hermaphroditic, where a single animal can have both the male and female reproductive organs.

- Urchins are dioecious (although it’s very difficult to tell if you have a male or female).

- The females expel a cloud of eggs into the water, and then the males release a cloud of sperm once triggered by the eggs. I think the eggs have a slight orange tinge, and the males are more white? Both AFAIK both look like visible milky substances.

- I saw this happen for the first time today! Both of the urchins got within a couple inches of one another (black longspines are ~6” long, so I thought they were fighting in their entanglement). One of them released ~8 waves of the milky fluid. Didn’t see any activity from the other. Could both be male, could both be female, could have had unreciprocated reproduction, or the 4th permutation: I may have observed fertilization! Will check for baby urchins, should occur within a week or two if any eggs get fertilized -> drop -> hatch.

- YouTube has a clip feature. You can loop 5-60sec of a longer video (and permalink it).

- Tournament styles: Round robin is where you play everyone else. Swiss is where you play people at a similar performance through the tournament (do well, play better opponents).

- Common tiebreak is Buchholz, which is the strength of the opponents. Add up all your opponents points. If higher, you had a harder tournament, and you win the tiebreak. Sometimes discarding the top and bottom scores. Useful in swiss.

- Remember (oversimplified): Scylla is the C++ version of Cassandra, which is Java.

- Of all the spices you can blacken on salmon, cumin has to be one of my favorites.

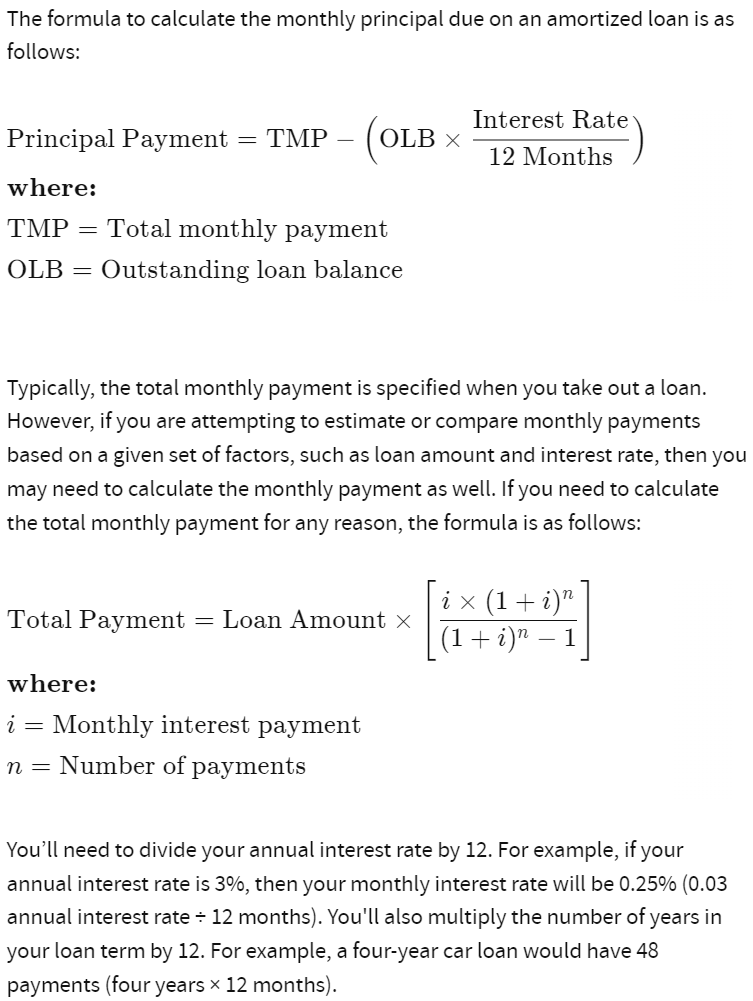

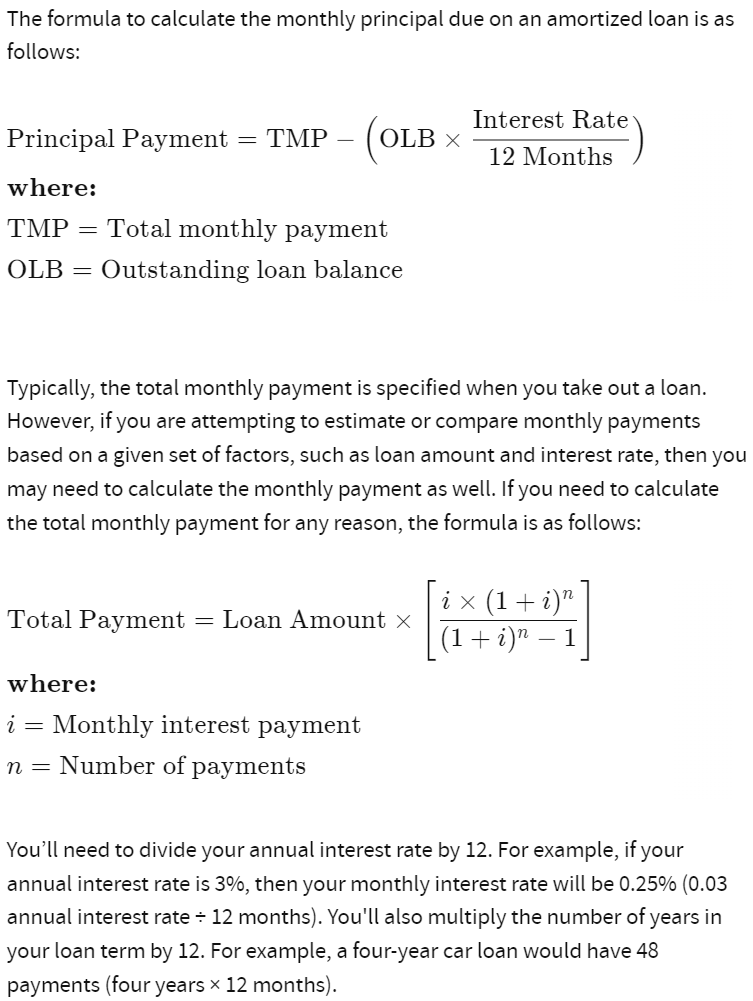

- Summary of a fixed term loan and its amortization schedule. How to calculate the total monthly payment (bottom first), and then what portion of that monthly payment goes toward principal vs interest (top equation).

- LoC interest payment is just average daily balance against your interest rate. If you pay monthly, just simplifies to draw for that month * interest. But daily interest calculation is better if you plan to pay it down more than once a month.

- LOTS of private work. Most productive day in a while.

-

- SBF landed in the US last night. Caroline Ellison (ceo alameda) and Gary Wang (cofounder ftx) pleaded guilty.

- Later, SBF released to house arrest on $250M bail. AFAIK, you don’t actually have to pay it, you just have to pledge collateral (in case you disappear) – this is his parents and their home. They’ll lose the estate and have to cover any extra to pay the 250M.

- And remember, bail is not a get-out-of-jail-free card. It’s just an incentivization to return at the later court date for your actual trial/sentencing/whatever. If you’re a public safety risk, or a flight risk, you don’t have the option for bail. You stay in custody until your date. But if you’re just going to sit around until the date, it’s less money/admin/etc for them to keep you; hence bail.

- Remember there are two factors in your success: things out of your control and things in your control.

- Say success is a gaussian distribution for things out of your control. Most are in the middle. Some people are extremely lucky (market conditions, time/place, etc), some are not (born into poverty, etc). Those are the tails.

- But the things in your control – these efforts move your gaussian distribution up the success axis.

- That’s why it’s less accurate to say something like “I am one of the most successful people in my age/demo/whatever bracket” – there will always be a person on a lower-centered gaussian curve that lands on the upper tail due to things they’re not responsible for. There will always be more successful people who did less.

- It’s more accurate to say something like “I did everything I could to be as successful as possible” – implicitly accounting for your circumstance. Shifting your normal dist as high as possible.

- Effort is not a shortcut to the top. It’s a maximization of your chances succeed. The result is never trivial.

- “Track Seventeen” on the original LOTR Howard Shore score is no longer the same number after the rerecordings – it’s “The Road Goes Ever On” (pt1) – https://www.youtube.com/watch?v=KiaUB7-tb_8

- MSG and RCMH allegedly run face scans on the entire audience for every event. If the scans of any attendee match certain criteria (competitors, criminals, opposing litigators, etc) then they’ll be asked to leave. https://www.morningbrew.com/daily/stories/2022/12/21/facial-recognition-used-to-bar-attorney-from-rockettes

- Chess.com finished the acquisition of the play magnus group, so chess.com now owns the following: chess24, aimchess, meltwater tour, chessable, many more. This also means that magnus will play in all the chess.com events now (good).

- Lots of private work.

- Messari released their 2023 crypto report: https://messari.io/pdf/messari-report-crypto-theses-for-2023.pdf

- Night and day, how much I understand last year vs this year.

- Decentralization? Over half of all staked eth is controlled by lido/coinbase/kraken. Over half of bitcoin’s hashrate is controlled by foundry/antpool/f2pool.

- Some necessary pieces for defi lending: onchain identity, credit scores, insurance, credit default swaps.

- Point-E (from OpenAI) produces 3D models from text. First it generates point clouds then converts them to meshes. Then you can 3D print them. So you can turn text into a toy.

- So we have text->text, text->image, text->3dModel, image->image.

- Rancher is a big alternative to k8s for orchestration. Remember there’s ECS, GKE, Openshift, Mesos as well. But many use k8s primitives under the hood.

- Podman is a big alternative to docker for containerization. Remember there’s vagrant as well, but VMs. And containerd, but docker uses that under the hood.

- Alternatives to bazel for monorepo build tools: nx, pants, earthly.

- Goldfinch.

- Borrow/lend curated marketplace. Just like maple.finance. You can act as the lender (investor) or the borrower (usually SMBs).

- If you’re the lender, you can be a direct backer to a business or a general liquidity provider. Backers have a junior claim (first loss) and LPs have a senior claim (last loss). This is to incentivize the backers to actually support the businesses they invest in (lend to). High potential returns for the backers.

- Borrowers propose terms. Rate, size, term, payment frequency, fees, etc. Auditors check these listings. Investors then lend into the junior and senior tranches as desired. Remember the backers supply directly to these exact terms for the specific borrower (junior tranche). The LP funds go to a central pool (senior tranche of all terms) that supplies all borrowers on the platform.

- Backed by a16z and coinbase ventures.

- https://goldfinch.finance/

- Lots of research on marketplace lending vs balance sheet lending.

-

- 1/400th of a percent of SpaceX (0.0025%).

- Warriors are 30th in FT attempts per game (19.4) and 30th in opponent FT attempts per game (26.3). Dead last on both sides. Could be that we’re the worst fouling team. As the multiple-championship squad of long-time veterans that we are. Or … there’s a bit of an imbalanced bias?

- Light in fiber optic cable (designed for long distance comms) moves at a speed that is less than 70% the speed of light in vacuum. The index of refraction of fiber is 1.468, so 1/1.468 = 0.68.

- Winter solstice. Days get longer from here on out.

- Lots of meetings and private work.

- Homemade peanut butter + protein bars.

- 10lbs peanuts.

- I like raw blanched, redskins are ok and add some nutrients but make it a little more bitter.

- Roast for ~35min at 350. 2 rounds of 2 baking trays.

- Let cool for ~15min.

- Food processor. Each tray is a round. Add ~1/2 cup of coconut oil to each round.

- Now you have 10lbs of peanut butter. Pour off about a quarter of it for standard peanut butter.

- Stir the rest with ~24 scoops of protein powder (banana and vanilla work great). Add a couple cups of oats. Add water or juice to make a little stickier if too dry. Add maple syrup or honey as well, to sweeten and stick. Add cinnamon or cocoa. Can be nibs for crunch. All optional.

- At the end of the day, it’s only 3 ingredients: peanuts, coconut oil, protein powder.

- Pour back into greased baking tray. Put in freezer for ~3hrs.

- Cut and wrap into 48 bars.

- Updated banner, committed lines, submitted picks.

- Used midjourney to generate images for prompts like “a handful of friends in hermosa beach wagering on NFL games” – full copies are in my discord DMs, but I put a collage (via canva) as the banner this week.

-

- Lobsters are gigantic shrimp. Prawns are in between.

- Updated vscode (1.74) and extensions.

- Finished the first season of Dark. Excellent.

- Lots of private work.

- Bank of japan getting ready to hike interest rates, big news.

- The Gemini Earn update page has said nothing in weeks: https://www.gemini.com/earn

- Avatar 2 was just Avatar 1 but underwater.

- SBF getting extradited.

-

- In addition to the genesis/dcg insolvency, gemini had data breaches: https://www.bleepingcomputer.com/news/security/hackers-leak-personal-info-allegedly-stolen-from-57m-gemini-users/

- 100 best shows of >2000: https://en.wikipedia.org/wiki/BBC%27s_100_Greatest_Television_Series_of_the_21st_Century. Heavy BBC bias. The Wire, Mad Men, Breaking Bad, Fleabag, Game of Thrones.

- Lots of private work.

- Sancerre is a great wine (origin).

- Someone used chatgpt to dispute a parking ticket and won haha: https://notesbylex.com/disputing-a-parking-fine-with-chatgpt.html (nothing revolutionary though, the human provided the key points – chatgpt really just composed the sentences here).

- Under the hood it’s two models. One to provide a response (the main one, the chatter) and another model to reward the first model by predicting human sentiment when reviewing the responses. The second one trains the first, so that humans don’t have to close the loop. Our upvotes/downvotes on chatgpt help train the latter model. Then they use the trained latter model to train the actual responder model.

-

- Tons of private work.

- My world cup bracket is the same number of points for every correct pick, no matter if in the round of 16 or the finals. Dumb. Didn’t know this at the start. Picked France to win it all. Equivalent to picking Brazil over South Korea 2 weeks ago.

- 50bps.

- Draw fee is to LoC as origination fee is to term loan. Whenever you draw on your line of credit, they take X%. Not once at the beginning for the max of the LoC, but for your actual draws, every time. Remember that a term loan is an LoC with 100% drawn. So if you’re paying a 3% origination fee, this is similar to a 3% draw fee on an LoC, but prorated since you withdrew less than the credit max.

- Went to The Yale Club.

- 401k is FID 500 (FXAIX), MFS Value R6 (MEIKX), FID Contrafund K (FCNKX). All large cap. YTD -15% ish.

- Remember the 401k, being offered by your employer, usually cannot be contributed to after you’re no longer employed there.

- So the primary benefit of the 401k (you can contribute more annually, and your employer usually matches a percentage) is gone.

- So an IRA is usually better when you’re unemployed. More investment choices/control, yielding better returns.