-

- The Secretary of State is named A. Blinken.

- The Block is a web3 publication: https://www.theblock.co/

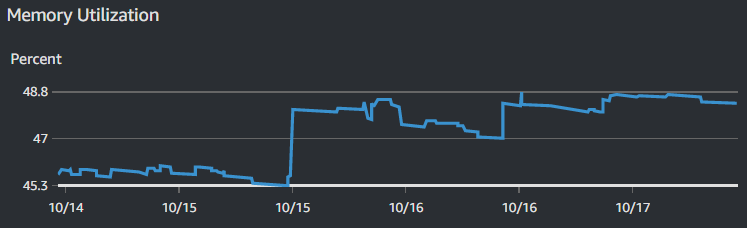

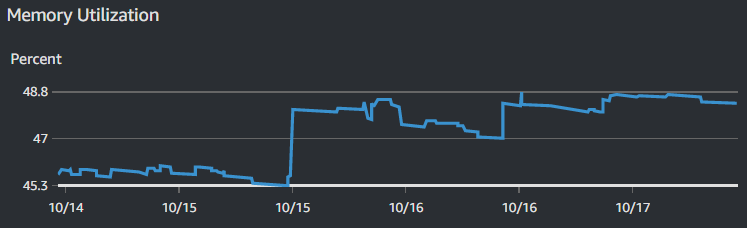

- Through the rush of sunday football on the first week of EC2 with double mem, looks fine and not leaky:

- 1GB was just a bit too small.

- Remember commercial banks vs boutique shops. The former usually has subdivisions; private bank, investment bank, wealth management, credit, mortgages, etc.

- Looked at Manhattan spooky attractions: Blood Manor, House of Spirits, Jekyll and Hyde’s Haunted Asylum, Blackout, Terror Haunted House, Nightmare Gothic. Got tickets for the last.

- Company work. Some legal, some pitch.

- ssh-keygen yf and E md5 lf to compare fingerprints of pubkeys with my private archive.

- Was having issues accessing the EC2 instance after I switched the keypair (from root user to iam user).

- The in-browser console connect capability of ec2 still works when you change access keys, but other usages do not. You obviously have to change your ssh client to use the new key (obviously, I did this), but ec2 does not automatically update the authorized_keys file.

- Run “ssh-keygen -f ~/.ssh/<>.pem -y” to get the pubkey and add that line to the authorized_keys file manually (via the ec2 console connect).

- Maybe EC2 does this automatically if you restart the instance or modify user data or something, but it’s a simple copy-paste to do it manually.

- Quant.

- HF, arb, bots, more. Many trading opportunities, algorithmic and automated.

- Develop a mathematical model. Backtest. Deploy.

- Feature extraction is kinda like dimensionality reduction. Take a complicated set of raw data and determine unique axes that matter.

- PCA (and ICA) are some methods of feature extraction (by determining magnitude/significance).

- Very common quant strategy = stat arb = statistical arbitrage.

- Analyze a TON of names and score them on arbitrage opportunity, then rank by risk.

- Hold the desired positions for a very short period of time (seconds to days, at most).

- Just like Pairs Trading. Coke is undervalued and pepsi is overvalued? Short pepsi and take a long position in coke. Briefly. This is done with groups of correlated names so that you can profit from both directions of the arb.

- Also called Mean Reversion. If there’s an expected normal (mean), you expect deviations to return to it (reversion). It’s the arbitrage opportunity.

- Overall: find names that are different from their expectation, and arb them back to the expectation (in pairs or groups of longs and shorts).

- 11st st jazz and comedy cellar 1130pm show.