-

- Zkrollup L2s are getting a ton of funding, starkware is at 6b valuation.

- Remember your Uniswap VP liquidity pool positions generate NFTs instead of fungible LP tokens (bc they’re not generic, you customize the concentration ofc). You can view these on opensea like any other. These are on whatever net you placed the position on.

- Unstoppable domain NFT is on polygon as well.

- Buildspace completion NFTs are on polygon as well (opensea.io, not testnets.opensea.io). They show up in your wallet in the “Hidden” tab rather than “Collected”. Or polygonscan, ERC-721TokenTxns tab.

- What network your browser wallet is on doesn’t change this; the opensea domain does.

- What account you see is based on what account you searched for. Your profile has a default one, but that’s not necessarily the same as your wallet default.

- Revisited my old olympus notes and wrote another summary.

- Sustainable liquidity is critical. Right now, we have liquidity on DEXs, but providers take their liquidity from protocol A to protocol B as soon as the rewards are better. Need a sustainable place for this, a central bank, a federal reserve. That’s olympus.

- But don’t use fiat. First; the reserves must be crypto. Second; the reserves should be a basket of various tokens, not a single. Need diversity.

- Ok, well that’s just a big dex. Bunch of liquidity across diversified crypto. How is olympus different? Because the protocol (treasury) owns the liquidity (POL). It can’t hop off.

- How can liquidity providers add to the treasury? Two options: bonding and staking.

- Option1: staking. You stake your OHM, delegating it to the treasury and adding liquidity. Then you make a % yield on the trade fees against that liquidity.

- Well how do you get OHM? Great question. The original method was bonding (although of course, now, ohm is popular enough to swap on most markets).

- Option 2: bonding. Anyone can buy bonds, using whitelisted (1) direct tokens or (2) liquidity tokens (pairs) – these are the tokens that make up the basket of the treasury. Why would anyone do this? They get OHM in return, at a discount. Which, again, has an APY you desire.

- OHM moves in relation to the market, and therefore its own treasury which holds OHM, of course. And the treasury is changing in size due to bonding/staking. When the price for OHM gets too high (ie the value of whole treasury divided by number of OHM in circulation, which today is ~440m/13m=$34), the treasury mints more OHM (increasing supply) in a rebase to reduce its demand/price. This OHM is distributed to stakers. When the price gets too low (but never below the floor price, 1DAI), the treasury will buy OHM back (from the stakers, again making them money) and burn it, increasing its demand/price (reducing supply). This is called protocol-controlled-value (PVC). It’s just the ratio of (treasury value / ohm quantity). It’s how much each OHM is backed by.

- So again, how do I make money? You stake OHM and get an APY, which is paid from liquidity mining as well as (getting newly minted ohm if the price goes up / treasury grows) or (selling ohm back to treasury if price goes down / treasury shrink). You may buy OHM on the market, or buy bonds to get it at a discount.

- Lastly, (and orthogonal to above): your staked OHM can be sOHM (regular staked ohm) or gOHM (governance, allowing votes + DAO participation). sOHM increases in quantity. gOHM increases in value.

- And a quick tokemak revisit. Note the APY scheme has two halves.

- You get an APY (in TOKE) by depositing <ASSET> into that pool (controlled by tokemak, varying %s, higher when assets<toke in pool).

- You get an APY (in TOKE) by depositing TOKE into that pool (from the liquidity mining of the pool).

- 8.2% of US homes are valued at >=$1mil.

- Added SVG extension to vscode; autocomplete, preview, minify, prettify.

- RSVPed+boughtRegistry for bchan.

- Holy hell, Intuit. 20 emails in the last 2 months from turbotax telling me to sign in and start my taxes. A reminder every 3 days, many with “early!” and “final!” terminology. Who approves this?

- GitHub Team (not org, a collection of people and repos) provides codespaces (basically cloud ide), scm settings (protected branches, multiple reviewers, draft MRs, code owners, etc), and more CI/CD minutes beyond the free plan. Enterprise plan goes further in minutes and storage and such, provides SSO, SOC1/2 audits, SCIM users, more.

- Remember to import the css with alertify.js.

- import alertify from “alertifyjs”;

- import ‘alertifyjs/build/css/alertify.css’;

- Tokemak’s TVL right now is 1.1b (bigger than Olympus’ treasury, almost 3x). 230m of that is TOKE, 877m is assets.

- Looked a little through npm, pnpm, and yarn. Would like to compare side-by-side with my old sx-setuptools.

- In addition to package managers, looked a bit through lerna, yarn workspaces, and other monorepo management tools. Played with pnp.

- Remember yarn comes with node by default starting with 16.10. Run “corepack enable” (and then “yarn set version stable” which is currently 3.2.0).

- ConventionalComments for comment classification in MRs: https://conventionalcomments.org/.

- Remember you can pass a second argument of [] to useEffect to make it behave like componentDidMount() but in a functional component, only rendering on first load.

- Position changes.

- Aave offers 0.11% APY on BAT deposits, Compound 0.13% (although +0.37% distribution APY in COMP). Both very bad, basically the same as eth and wbtc. Celsius offers 1%, but not decentralized (although they’re working on a defi arm, celsiusX: https://celsiusx.io/). Enabled collateralization, but did not leverage the position. Borrow APR is higher than deposit APY, and no partner sponsorships or anything.

- Rebonded my DOT above the onchain minimum (160). Nominated different validators, my old selections were oversubscribed/inactive/pending. Submitted for 7 new. Right now there are 21281/22500 nominators (they need to increase max).

- Remember LUNA on gemini is an ERC-20 token. Withdraw to metamask then bridge to the terra chain to your terra station wallet. Delegated a lot of this after.

- Swapped DAI for OHM, add to an LP of that pair on sushi, then bonded the LP tokens on olympus (2 day vest then claim sOHM). Remember that with olympus v2, bonds are autostaked during the vesting time.

- Deposited a large amount of DAI into its tokemak reactor (4% right now, although close to 5 based on current ratio). As TOKE rewards accumulate over the few cycles, I’ll stake it as votes for compounded APY.

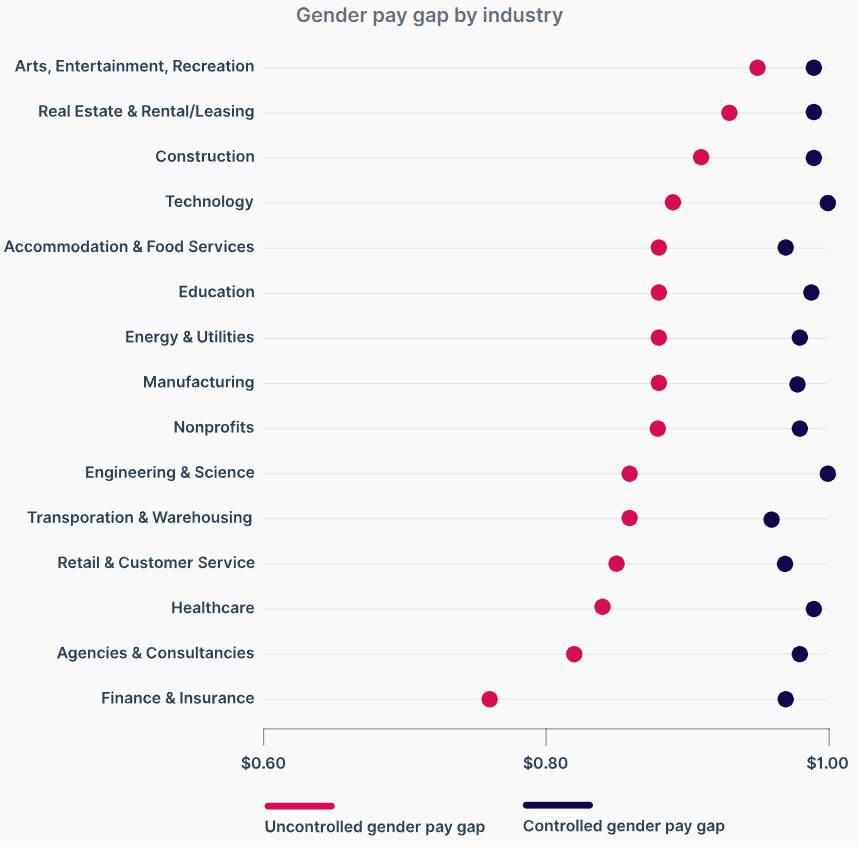

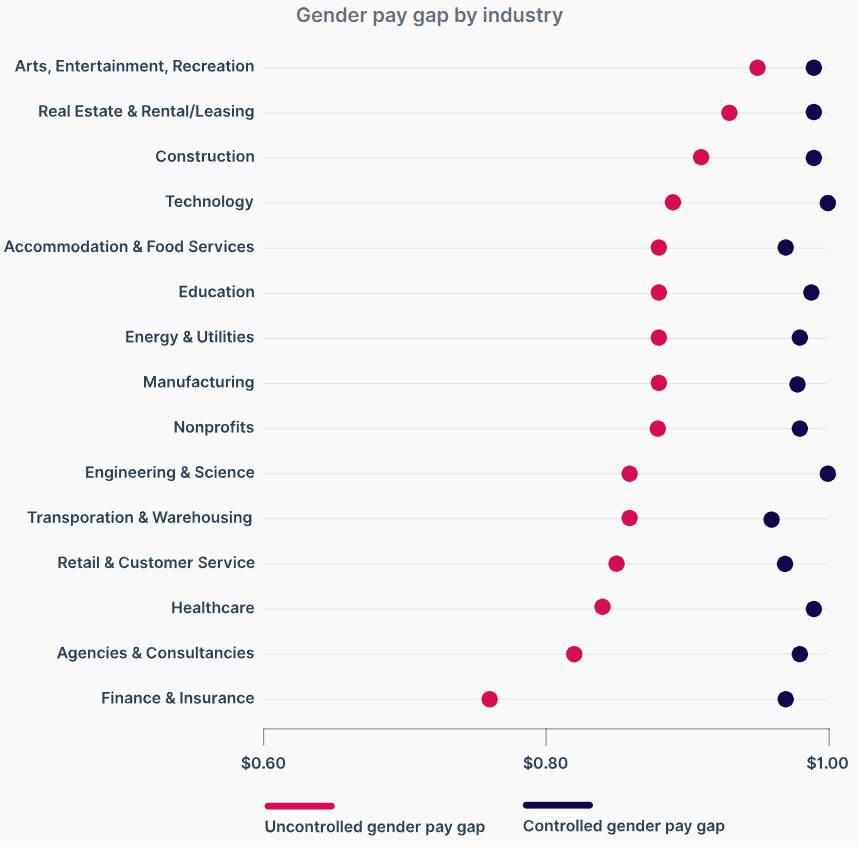

- Interesting article on the state of the median gender pay gap at the end of 2021.

- https://www.payscale.com/research-and-insights/gender-pay-gap/.

- All men compared to all women: 82 cents on the dollar.

- Men compared to women with the same title, years of exp, education, industry, and location: 98 cents on the dollar.

- My fields (tech and engineering/science) both highest rates of equality – interesting.