-

- DeFi 2.0.

- First: why?

- Look at incentive. Most protocols offer high incentives of their native token for people to provide liquidity to their protocol. This is risky though; all these providers will hop to the next shiny protocol when the incentive offer is better. Often someone forks the protocol, increases the incentive by 1%, then motivates everyone to hop over to their new token (all within a day).

- Vesting will slow this down, but does not avoid the issue.

- You can also build brand (uniswap).

- Need a more sustainable way to keep liquidity providers together longterm. Enter defi 2.0. Basically crypto reserves for the whole market.

- OlympusDAO (OHM) was the first, announced on medium in feb 2021. It’s been 1 year. Wonderland (TIME) is another (on avalance), as well as KlimaDAO (KLIMA).

- Tokemak (TOKE) too. I’ll start with the generalized theory, using Olympus as the example (it was the first) and then discuss the others.

- OHM and TOKE are called the protocol tokens (obviously).

- A difference: other stablecoins (usdc, dai, tether) are pegged to the dollar. If USD has inflation, all these pegged stablecoins have the same inflation. These defi2 projects are backed by a treasury (eg OHM tokens), so they aren’t married to fiat.

- And technically, backed means that it can rise in value to above the asset basket that backs it. It just can’t go below. OHM >= 1 USD.

- This treasury has a wide variety of reserves (a “basket”), but is diversified across various crypto products. It will follow the market.

- This treasury is just like the fed, just like a central bank, but is decentralized bc it’s controlled by a DAO (eg holders of the OHM token for Olympus).

- This treasury is a gigantic liquidity pool.

- When the treasury token (OHM) trades above the value of its reserves (backed assets), the protocol dilutes by minting and selling more of the token (OHM), dropping the price to stabilize (increase supply, reduce demand).

- When the token trades below its reserves, the treasury buys it (OHM) back and burns it, reducing supply and increasing price.

- This is call PCV, protocol-controlled value.

- Both considered, the floor price is then 1 DAI (what it was originally backed by). Right now, OHM is $36.

- Then to grow and expand the protocol, the treasury offers bonds. Send crypto, receive the treasury token (OHM) at a discount. You must hold for a certain period of time (5 days for olympus); this is what provides liquidity to the treasury.

- Bonders make a profit then if OHM increases in value.

- Just think of a gigantic melting pot of precious metals. A federal reserve will take your gold and silver and diamonds and oil and give you corresponding dollars in return. But instead of physical assets, we used digital assets with crypto. The melting pot is the treasury, the dollar is OHM. Just a big database where people own backed value. But unlike a dex, where the users own the liquidity of the reserve and can take it anywhere else; defi2 is protocol-owned liquidity (POL), where it can sustainably remain.

- This treasury makes profit. Remember, it’s a gigantic liquidity pool, while serving as reserves. This LP collects fees, just like any LP.

- You can then stake OHM back. You’ll earn yield (OHM) from the liquidity mining fees mentioned just above.

- Staked ohm is sOHM. You used to have to wrap this in order to participate in the governance, where you’d wrap sOHM to wsOHM. This extra transaction cost gas/time, so now in v2 you can stake directly to governance ohm, and they changed the name accordingly from wsOHM to gOHM (you can still wrap/unwrap to sOHM as desired).

- gOHM quantity doesn’t change, but its value increases. This is unlike sOHM, which changes in quantity (not value) upon rebase (or every epoch, not sure). https://docs.olympusdao.finance/main/basics/migration#will-my-gohm-still-earn-rebase-rewards.

- Note that staking here doesn’t mean delegation of funds to a validator for PoS block confirmation. It’s just the generalized word for a passive yield strategy that generates APY based on delegating your funds for some purpose. In this case, it’s providing liquidity and/or treasury backing.

- For Olympus, what you can buy bonds with? https://docs.olympusdao.finance/main/using-the-website/bonds.

- Direct assets: DAI, FRAX, and wETH.

- You may also buy bonds directly with LP tokens. OHM-DAI and OHM-FRAX.

- When I checked just now, the only way to bond was with UST direct (2.42% discount) or OHM-DAI LP (4.38% discount). Each 2 days.

- In this way, the DAO owns all the liquidity. This is what is more sustainable/stable than standard DEX liquidity pools. Liquidity miners just take their liquidity and hop to the next protocol with better incentives. Can’t do that in defi2, because the protocol itself owns the liquidity. Right now, OlympusDAO owns 99.67% of all OHM-X liquidity for exactly this reason.

- Putting it all together:

- If there are 1 million OHM in circulation, and 10m of crypto (in equivalent USD) in the treasury, then each OHM is backed by 10 USD, and the protocol will mint 9 million OHM to restore 1:1. This action is called a rebase. These minted OHM tokens are given to the stakers. That’s what allows crazy high APYs.

- Well, how does the treasury grow? Again, back to bonding. People provide their stablecoins or liquidity tokens and get OHM in return.

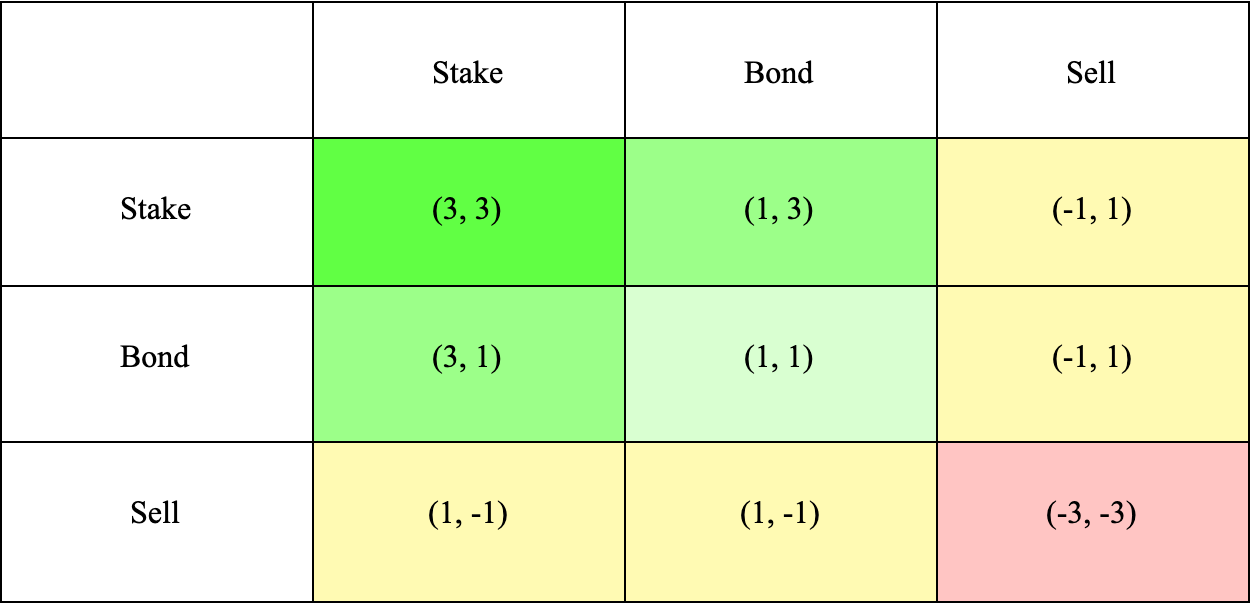

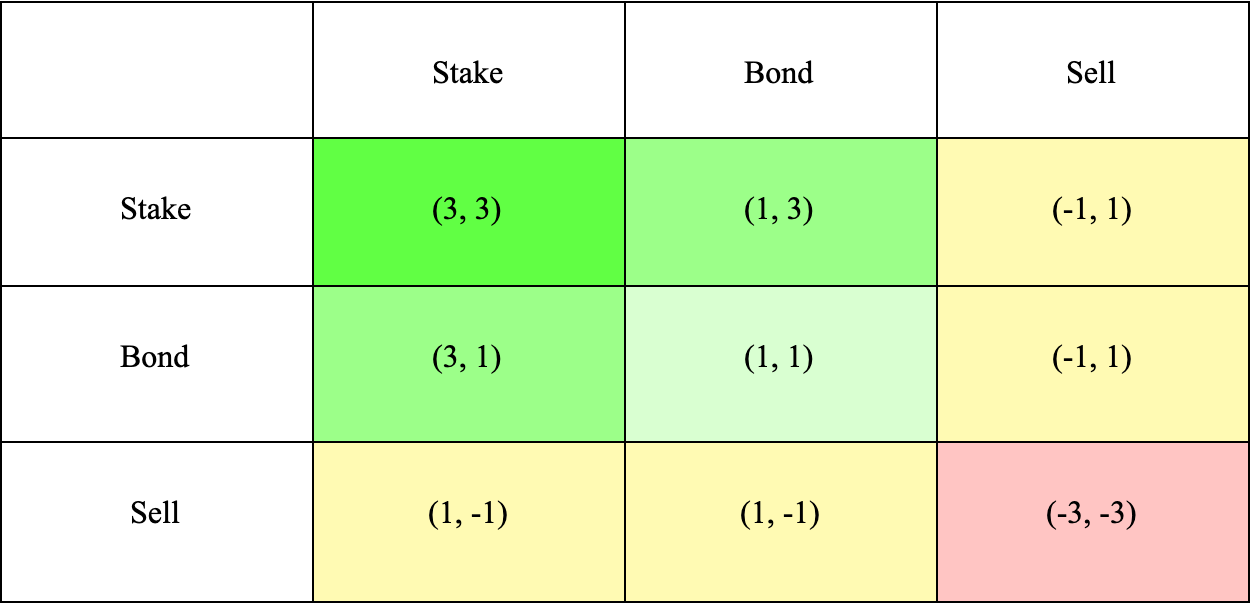

- Best case: everyone stakes OHM longterm. Worst case: everyone sells. this is the (3,3) you see sometimes. Go back to game theory.

- Staking takes ohm off the market. Best case, since the actor benefits (yield) and the protocol benefits (ohm price increase).

- Bonding is in the middle. The actor gets some reward (discount), and the protocol gets some benefit (liquidity). No price move.

- Selling is the worst. Good for the actor (profit) but bad for the protocol (ohm price decrease).

- Ultimately, the goal would be for OHM to become the global digital currency.

- To get OHM initially: bond it from the treasury, or buy it on the open market.

- UPDATE: Now Zapper (via https://zapper.fi/) allows you to swap directly into a staked OHM position. Convert your eth/bat/wbtc/whatever directly into gohm.

- They plan to offer zap-bond soon, so you can do the full bond process in a single click as well (swap half to dai, swap half to ohm, add pair to lp, bond lp token).

- OlympusDAO offers Olympus Pro; basically its bonding mechanism but as a service. Your protocol can offer a token as an incentive, but sell it as a bond to bring liquidity back to the protocol itself. Stabler growth, better longterm.

- Olympus V2 improved a few things; primarily allowing bonded OHM to be staked during the vesting time.

- OlympusDAO’s treasury only needs 4 of 7 multisigs? Could be bad.

- I think Olympus only works on eth mainnet. Checked today, https://app.olympusdao.finance/ does not allow bonding/staking on polygon/optimism/arbitrum.

- It currently has 444.7m (market value) of treasury assets.

- Right now, 80.8% of all OHM is staked.

- APY is currently 905.7% for staking.

- Be careful on exchanges; use ohm v2 rather than ohm v1 (although the dapp can migrate for you, extra gas fee).

- Tokemak.

- Oversimplified: tokemak is a wrapper around DEXs and has a native token (TOKE) for holders to vote on which market (DEX) the liquidity of each asset goes to.

- Ignore the new words they try to introduce: reactors=pools, democratization=decentralization, liquidity directors=voters/stakers. Complexity from unfamiliarity doesn’t automatically ooze intelligence.

- Can also replace “liquidity” in all the descriptions with “bandwidth” from the internet era. Having bandwidth caused an explosion of products/sites/games/whatever. Same here. But talking about value flow instead of data flow.

- Carson Cook, launched summer 2021.

- A tokamak is a fusion power device that holds plasma with magnetic fields. Fuses atoms, produces sustainable energy. Tokemak gathers tokens and produces liquidity. (…….)

- In the same way, each asset has its own pool (called a reactor). Liquidity providers (not calling them LPs because it’s ambiguous with liquidity pools) put an asset into a reactor. Liquidity directors use TOKE to decide where the liquidity should go. If you hold TOKE, you can participate in this.

- As you might expect, liquidity providers get yield in TOKE, not the asset they deposited nor an LP token. While TOKE is general, liquidity directors will stake (delegate) it back into a specific reactor (pool) to give themselves voting rights to direct the liquidity of that pool (not all pools).

- Note than in this model, impermanent loss is now a risk of the voters=TOKEholders=DAO (liquidity directors), not the liquidity providers (like in current defi1 DEXs).

- tAssets are held in smart contracts (and burned on withdrawal) as claim receipts of the actual deposit, just like cAssets on compound and aAssets on aave. If I provide BAT, I get tBAT back, and can exchange it 1:1 for my original BAT at any time (removing the liquidity I provided).

- Balancing.

- If a reactor/pool has a lot of assets, but only a few voters staking their TOKE to direct it, their APY is higher (because the voters who directed the liquidity of that pool get the fees earned from that liquidity, divided by fewer people). So more people will be attracted to stake toke in that pool, and balance is organic.

- Same in the opposite direction. If there’s a small amount of assets in a pool but a lot of liquidity directors, they earn a smaller cut and are incentivized to direct/stake another pool/reactor.

- Same applies for the liquidity providers. More stakers than assets? Add assets and you get better TOKE returns. More assets than stakers? People who want to add additional assets as liquidity will have diminishing returns.

- Early phase roadmap (cycle zero).

- DeGenesis Event. Just eth and stablecoin reactors.

- Collateralization of Reactors Event (CORE). Whitelisted/curated pools/reactors compete.

- Genesis Pools. Users can use the pools that won.

- Again, just eth mainnet (for now).

- https://www.youtube.com/watch?v=vum5l-acbm0.

- Nice side perk – tokemak allows liquidity providers to deposit single assets; don’t need pairs.

- Built (originally) for new daos/protocols/tokens. I can create a reactor/pool for my new token and incentivize people to bring liquidity to it. If a bunch of toke holders come stake there, naturally liquidity providers will flow to bring a balance (see APY balancing section above). So if originally have a small seed of users on uniswap, let’s say, I can use tokemak to basically “encourage” (force via incentivization) users to add to THAT liquidity, rather than a separate pool on sushiswap. Or, distribute it evenly if that fits your model better. Tokemak will show you the distribution across exchanges right alongside the trading volume on each, so you can measure success.

- You can also kinda think of tokemak like gofundme for defi. New projects can attempt to launch, and if people support it, they can invest and the project grows. Except instead of USD to bring people up, the whole tokemak dao has TOKE tokens instead. They can “invest” (stake) that in any project (pool/reactor of a new token) and funds will organically flow to their project and provide liquidity (reserves, funds, many use cases). The whole tokemak community then becomes this giant liquidity machine with TOKE being used as a fungible router.

- This is also the incentive to participate in a system like this. If you provide liquidity, you get a vote in this community via TOKE, and TOKE also becomes your effective “share” of the gigantic pool of liquidity (can collect fees, withdraw, all the usuals). It’s backed by this reserve. Sustainable longterm, because it’s a protocol wrapper around exchanges, and uses its liquidity pool as a gigantic reserve, rather than a dex protocol that can be 1up-ed with a shinier incentive tomorrow.

- They also act like a vc arm (loosely) in the beginning, if desired/necessary. “Hey new protocol, here’s some TOKE in your pool/reactor to bootstrap your ability to direct liquidity, give us some tokens.”

- Eventually can spread across chains, down to L2s, more. Can even route liquidity to other protocols OTHER than DEXs, like voting to send a bunch of reserves to yearn or something and generating direct APY for the holders.

- Overall benefit as a liquidity provider, compared to just directly adding to the dex pool of your choice: avoid impermanent loss, provide as low as a single asset, compound yield from lp AND ld.

- Ultimately, if tokemak black holes everything (good), you have a gigantic liquidity pool that can be directed anywhere in realtime. This means 0 slippage and best rates across the board.

- LUNA directly into terra station wallet via transak.

- They require KYC, so you have to provide a bunch of ID once.

- Limits per day/week/month/year: 500/1000/5000/60000.

- https://haveibeenpwned.com/.

- Google Meet is pretty seamless. Free, all in browser, connected to gmail and gcalendar, share screen/window/tab capability, whiteboard (and saved into gdrive), quick share link, host controls for mute/video/etc, backgrounds (including blur), chat. Surprise feature: captions, live transcribing of all speakers.

- Searched for a way to allow multiple rows of bookmarks in chromium. No native way, and no current extensions. There used to be one called Roomy Bookmarks but cancelled, and there are a few others that don’t look safe. I’ll probably write one myself. I strongly prefer multiple rows, all icons, no text, no folders.

- KMS = key management system / HSM = hardware security module. Cryptography/security solutions.

- Connected airpods and sony headphones to win11 via bluetooth dongle, can now use wireless audio with video.

- Staked some OHM into gOHM today. Will bond OHM-DAI lp tokens shortly for more ohm to stake.

- Excellent overview of Carta.

- From tribe capital: https://tribecap.co/1-trillion-in-equity-how-carta-is-set-to-unlock-the-private-markets/.

- Focused on the atomic unit of equity.

- “N of 1” – companies/products that are capable of becoming much larger than what people expect early on. They explode. Think of the opposite: “1 of N” – a bunch of companies with decent ideas, among which any could take off, largely determined by atmosphere/luck/etc.

- Often the key lies in the potential scale of the market.

- Strategy: find a generational “atomic unit of value” – think oil of the resource generation, or bandwidth of the internet generation, or user mobile phone convenience of the uber era, or friend graph / social interaction of the facebook era. Then capture it and turn it into a utility or a service you provide.

- Now carta. First an easy management system for your equity. Cap table mgmt. As well as managing 409As and private valuations. But then growing into full equity management and defining the atomic unit of equity.

- Equity is more popular nowadays than it used to be; RSUs, ISOs, these are common for most employees. Incentivizes good teams, trickling ownership down. It’s not just founders anymore; employees are owners.

- Equity also helps attract and retain high-skill talent.

- Equity is also the fuel for entrepreneurship.

- Remember; there’s also less incentive to go public nowadays than there used to be. Staying private is better in many cases.

- But private equity is much less liquid. Bringing liquidity to private equity would be a very lucrative opportunity.

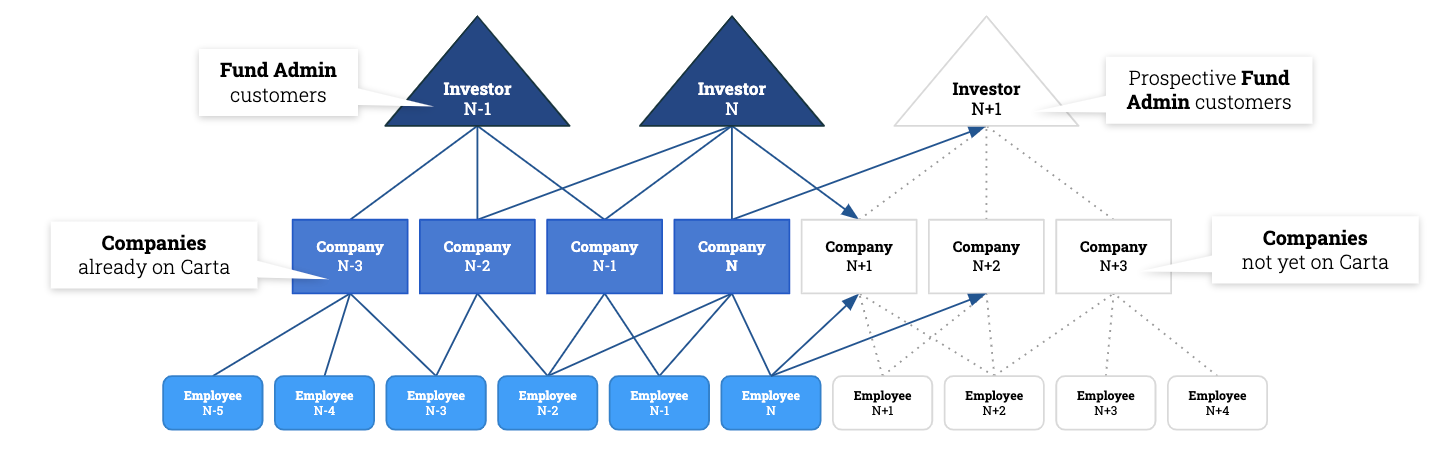

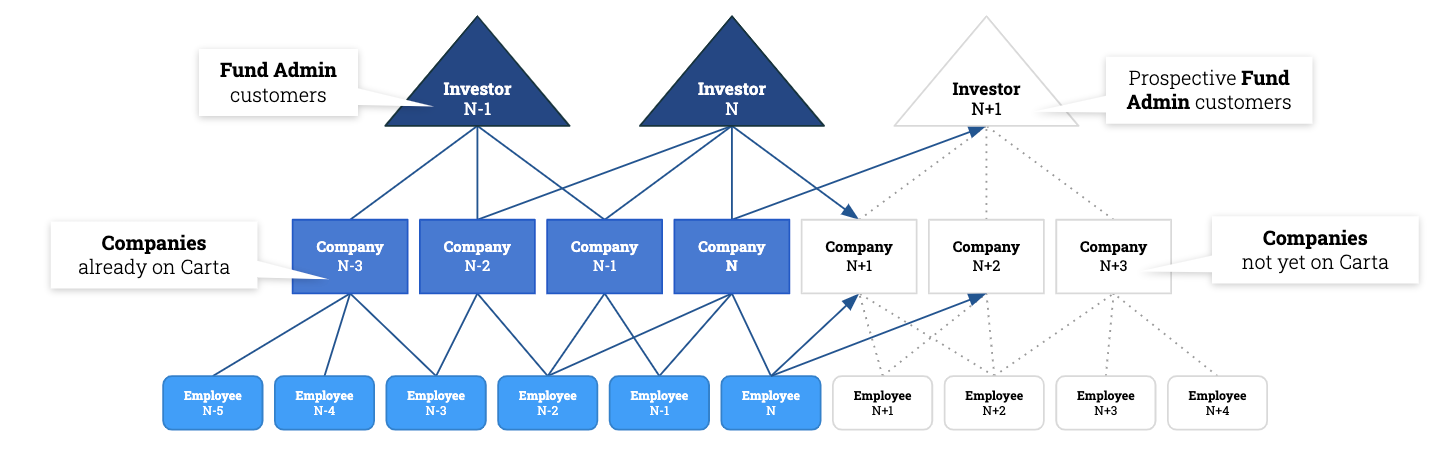

- Then your network grows as you build nodes on the graph. Employees, companies, and investors. See this image and what you could do with it.

- This makes onboarding easier. Effectively a schema for all 3 types of nodes. Imagine a startup comes to an investor and already has a carta cap table in their terms, and one of the founders already worked at a company that used carta. The investor was already familiar with carta. That process became 5x faster to add the new company node to the graph.

- It’s a disadvantage to not manage your fund with carta. Soon that pool will shrink until basically all US companies manage their equity with this system (the goal).

- The article is from 2020, and they claim that carta has the ownership graph (equity records) for 35% of all companies backed by US VCs. This is over $1T of equity managed on their platform. They managed equity for over 15k companies and 1M stakeholders. Not sure what today’s numbers are.

- And then remember CartaX, the private equity market that offers ever-so-needed liquidity. If the companies allow, you can basically link the entire buy side (any accredited investor) and the entire sell side (any shareholder in a private company).

- Right now, CartaX only allows institutional investors. Accredited individual investors will be allowed on the platform in the future.

- Carta used to be called eShares.