-

- Remember Brave’s browser-native (fast) wallet only supports EVM-compatible chains, including L2s. Sure, it could replace metamask, but not phantom/terrastation/keplr/yoroi/etc.

- Google analytics started flowing for bmahlstedt. I should add to supercontest as well.

- FIDE Grand Prix leg 1 finished, Hikaru.

- Liquid staking. Some general info on the protocol, as well as sol+eth specifics.

- Marinade (sol).

- You still have access to your funds while yield farming. You stake your sol, earn the apy on that, and then receive msol. You can then use the msol for additional yield (add it to liquidity pools, savings, whatever). Current rates are about 6.25% APY for the original sol, then whatever you can get with msol on your own.

- They delegate to a number of validators so you don’t have to. Like an index.

- They choose lower validators, to further decentralization: https://docs.marinade.finance/marinade-protocol/validators.

- https://github.com/marinade-finance.

- You can also stake an already staked account with marinade. Not sure how that works. My guess is that they redelegate it and you stop accumulating rewards with the original validator (getting marinade’s instead). Few answers on https://docs.marinade.finance/faq/faq.

- Staking rewards are paid back directly to the account, so you don’t “lose” rewards. You stake accumulated extra in the stake account. This is true of standard sol as well as marinade msol.

- Synthetify on Solana. A DEX that supports “synthetic assets” that can represent tokens, equities, commods, anything. https://synthetify.io/resources/synthetify-whitepaper.pdf.

- They also have vaults, a generic term used across a number of DeFi products; just means a passive income opportunity. A savings account of sorts, with much better interest. They give you an APY while they use your money for various opportunities behind the scenes (liquidity, market making, etc).

- Lido (eth, primarily).

- Supports staking eth2 (4.6%), terra (9.5%), and sol (6%). Obv eth2 for pos not pow. You get stETH, stLUNA, stSOL.

- https://lido.fi/static/Lido:Ethereum-Liquid-Staking.pdf.

- https://github.com/lidofinance.

- Does NOT support staking eth on sidechains or L2s. Only eth mainnet.

- Then get additional stETH yield (or wrap to wstETH if your second product requires a static account balance) on a liquidity provider or however you’d like. Curve and yearn have good options.

- Zaps are bundled transactions across multiple smart contracts. Common in DeFi. Saves on gas fees and time. Example: approve access, deposit, borrow, wrap, send, swap, unwrap, send, etc. Just do it in one. Helpful for doubleyield flows like this.

- Decentralized lending. Some general info on the protocol, as well as sol+eth specifics.

- Simpler than you think. Deposit X, which can then be used as collateral to borrow Y. Y obviously can’t go above X.

- The borrow limit (consider it yellow) depends on the loan-to-value ratios of the specific tokens you’ve deposited. Some are safer than others. https://docs.solend.fi/protocol/parameters/main-pool.

- Above the borrow limit is the liquidation limit (consider it red). Above this threshold, your account is eligible for liquidation.

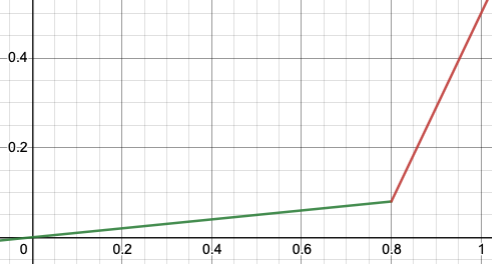

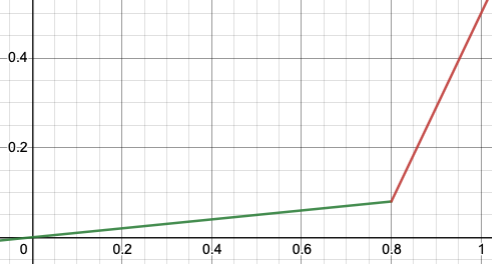

- Borrow APR: (https://docs.solend.fi/protocol/fees#borrow-apy)

-

- This borrow APR goes to supply APY. The people receiving loans are paying interest to the financiers, of course (although it’s not 1:1).

- Solend for supply/borrow on solana blockchain: https://solend.fi/.

- Aave for supply/borrow on the ethereum chain, primarily: https://aave.com/.

- They also support polygon and avalanche. It’s only 0.7% supply APY for MATIC right now.

- Aave also allows staking, but only for AAVE token.

- You don’t need to borrow the same token you supplied. It’s a net-value situation.

- While borrow APRs are higher than supply APYs, you can achieve a net negative APR to borrow due to some rewards programs. Example here: https://docs.solend.fi/protocol/liquidity-mining. If you borrow SOL, you owe an APR but you also receive SLND tokens. If these appreciate greater than your borrow APR, you are making money by taking the loan.

- Stake sol on marinade -> msol -> deposit msol on solend -> accure mnde and slnd rewards -> collateralize to borrow sol -> accrue slnd rewards -> third-yield the sol however you’d like (LPs, vaults, do it again for more leverage, etc).

- Joined a few discord servers, reddit communities, twitter follows, bookmarks, email newsletters, the usuals.

- Enabled 2FA on npm.

- A little disappointed at how many defi platforms are still (only) on ethereum mainnet. Even mature, good ones. Still on L1.

- PLTR still not great.

- Reddit list of rugpulls: https://www.reddit.com/r/dao/comments/r9re6z/list_of_rug_and_pull_daos/.

- Takes 7 days to withdraw from both arbitrum and optimism back to L1. Polygon withdrawal back to eth mainnet takes ~3h.